In the rapidly evolving world of cryptocurrency, traders now using Base, are constantly on the lookout for tools and strategies that can give them an edge. Among the most significant innovations in recent times is the integration of Telegram trade bots within the Base Network ecosystem. These bots have revolutionized the way traders interact with the market, offering unparalleled convenience, speed, and a suite of powerful features like Sniping, Copy Trading, Dollar-Cost Averaging (DCA) mode, and Bridging. This blog explores how these bots are transforming the trading landscape and why they’ve become indispensable for modern traders.

Base Network Trading Bots

- SIGMA : Eth Base Bsc Degen Blast Bsc Avax Ftm +

- MAESTRO BOT : Sol Eth Base Blast Bsc Arb Ton TRON Metis READ MORE

- BULLX: Hybrid DEX Telegram BOT ETH SOL BASE ARB BLAST READ MORE

- DBOT: ETH BASE SOL ARB BSC BLAST AVAX FTM Read More

- BLAZING BOT : SOL ETH EVM

- NFD BASE TRADE BOT : BASE

- UNIBOT: ETH BASE BSC ARB

- SHURIKEN : Sol Eth Base Avax Arb Bsc Ftm Runes READ MORE

- BAZOOKA BOT : SOL ETH BASE ARB OP BSC

- POCKETFI: ETH BASE BLAST OP ARB MINE $SWITCH

The Convenience and Speed of Telegram Trade Bots

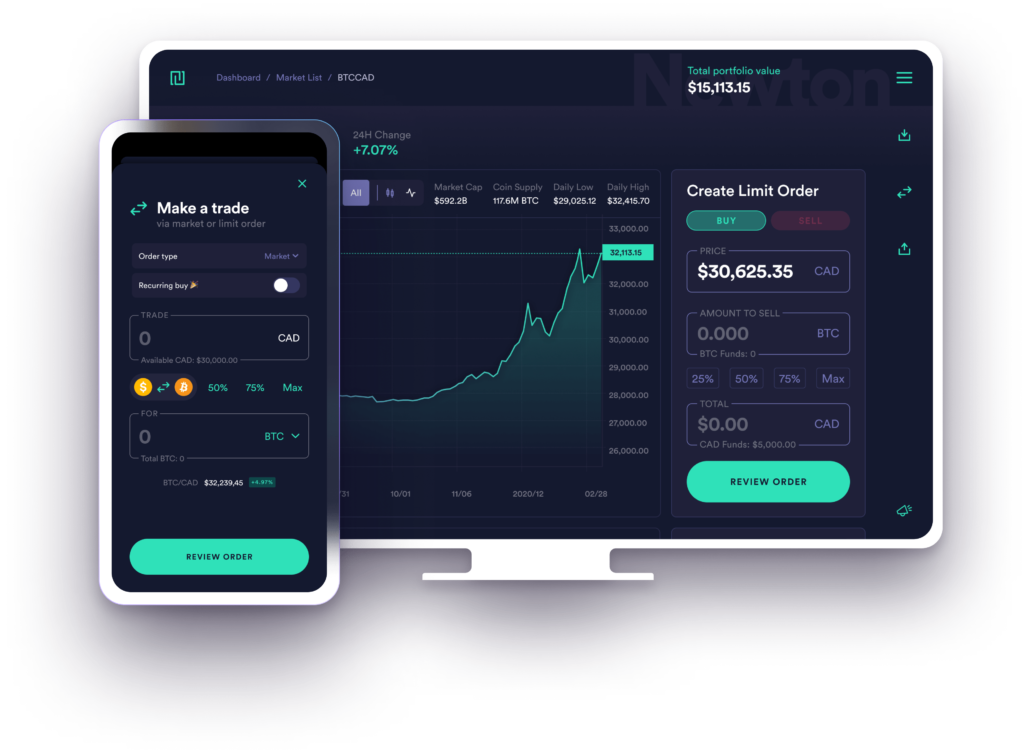

Telegram trade bots bring the trading desk to the palm of your hand. By operating within the Telegram app, they eliminate the need to constantly monitor exchange platforms or navigate through complex trading software. Traders can receive real-time alerts, execute trades, and manage their portfolios directly from their smartphones. This level of convenience means that opportunities are never missed, even when on the move.

The speed at which these bots operate is another critical advantage. In the volatile crypto market, prices can swing dramatically in a matter of seconds. Telegram trade bots can execute trades almost instantaneously, capitalizing on these fluctuations to maximize profits or minimize losses.

Key Features of Telegram Trade Bots on the Base Network

Sniping

Sniping refers to the practice of quickly entering and exiting trades to capitalize on initial price movements. This strategy is particularly effective during token launches or when new listings are announced. Telegram trade bots on the Base Network can automatically detect such events and execute buy or sell orders faster than a human trader ever could, often securing advantageous positions before the market reacts.

Copy Trading

Copy Trading allows traders to mimic the strategies of more experienced or successful traders automatically. Once a trader opts to copy another, their bot will execute the same trades in real-time, adjusting for the copier’s portfolio size. This feature democratizes trading strategies, allowing less experienced traders to benefit from the knowledge and insights of seasoned veterans.

DCA Mode

Dollar-Cost Averaging is a strategy employed by investors looking to build their positions over time. By regularly investing a fixed amount, regardless of the asset’s price, traders can mitigate the impact of volatility. Telegram trade bots automate this process, executing purchases at predetermined intervals, which helps in smoothing out the average purchase price over time.

Bridging

As the crypto market matures, the ability to move assets across different blockchains (bridging) has become increasingly important. Telegram trade bots facilitate this process, allowing traders to quickly and efficiently bridge assets between the Base Network and other chains. This capability not only opens up a broader range of trading opportunities but also enhances liquidity across the ecosystem.

Wallet Monitoring

Wallet Monitoring, offers traders real-time insights into their wallet’s status, including balance changes, transaction history, and asset distribution. This tool is particularly useful for keeping a pulse on portfolio performance and making informed decisions based on asset movement and trends. Wallet Monitoring enhances security by alerting traders to unauthorized transactions, ensuring that they stay one step ahead in safeguarding their investments.

The Impact on Traders

The introduction of Telegram trade bots on the Base Network has significantly lowered the barriers to entry for new traders while providing seasoned traders with powerful tools to enhance their strategies. The convenience, speed, and range of features these bots offer have led to more dynamic and responsive trading strategies, better risk management, and, ultimately, a more inclusive trading environment.

Passive Income Opportunities

Telegram trading bots, with their innovative approach to cryptocurrency trading, also offer unique passive income opportunities through referral systems and revenue sharing models for holders. These mechanisms provide an additional layer of financial incentives beyond the traditional profits derived from trading activities. Here’s a breakdown of how individuals can leverage these opportunities to generate passive income:

Referral Systems

Many Telegram trading bots feature referral programs designed to expand their user base through word-of-mouth and user recommendations. Here’s how it typically works:

- Unique Referral Links: Users receive a unique referral link upon signing up for the trading bot service.

- Sharing and Promotion: This link can then be shared with friends, family, or followers on social media. The idea is to promote the bot to potential new users who might be interested in automating their crypto trading.

- Rewards for Referrals: When someone signs up using your referral link and starts using the bot for trading, you receive a reward. This reward could be a percentage of the trading fees generated by the new user, a one-time payment, or other incentives as defined by the bot’s referral program.

The more active users you refer, the greater your potential passive income through this system. It incentivizes current users to promote the bot, contributing to its growth and success.

Revenue Shares to Holders

Another innovative passive income opportunity provided by some Telegram trading bots is revenue sharing with token holders. This model rewards users who hold the bot’s proprietary tokens or a specific cryptocurrency in their wallets. Here’s how it works:

- Token Ownership: Users purchase or earn proprietary tokens associated with the Telegram bot. Holding these tokens grants them a stake in the bot’s ecosystem.

- Revenue Sharing: A portion of the profits generated by the bot from trading fees, subscription fees, or other income sources is distributed among token holders. This distribution is often proportional to the amount of token one holds, meaning the more tokens you have, the larger your share of the revenue.

- Periodic Payouts: These dividends or revenue shares are usually distributed on a regular basis, such as monthly or quarterly, providing a steady stream of passive income to holders.

This model not only offers financial benefits to token holders but also aligns the interests of the bot developers and its user community. By holding tokens, users are directly invested in the success and profitability of the bot, creating a community of users who are motivated to see the bot grow and succeed.

Base Network Trading Bots

- SIGMA : Eth Base Bsc Degen Blast Bsc Avax Ftm +

- MAESTRO BOT : Sol Eth Base Blast Bsc Arb Ton TRON Metis READ MORE

- BULLX: Hybrid DEX Telegram BOT ETH SOL BASE ARB BLAST READ MORE

- DBOT: ETH BASE SOL ARB BSC BLAST AVAX FTM Read More

- BLAZING BOT : SOL ETH EVM

- NFD BASE TRADE BOT : BASE

- UNIBOT: ETH BASE BSC ARB

- SHURIKEN : Sol Eth Base Avax Arb Bsc Ftm Runes READ MORE

- BAZOOKA BOT : SOL ETH BASE ARB OP BSC

- POCKETFI: ETH BASE BLAST OP ARB MINE $SWITCH

Conclusion

As the Base Network continues to grow and evolve, the role of Telegram trade bots within this ecosystem is set to expand further. By leveraging these bots, traders can navigate the complexities of the crypto market with greater ease, speed, and efficiency. Whether you’re a novice looking to dip your toes into the world of crypto trading or a seasoned pro seeking to optimize your strategies, the integration of trading bots and the Base Network offers a compelling toolkit for success in the digital age.